Insert your debit card or enter your registered mobile number. The first step to using a Micro ATM is to insert your debit card into the device or enter your registered mobile number linked to your bank account.

Discover the possibilities today with our m-ATM!

Experience the future of convenient banking with m-ATM—your all-in-one solution that empowers retailers to serve their customers effortlessly. This innovative device works just like a traditional ATM, allowing users to withdraw cash, check account balances, and perform basic banking transactions anytime, anywhere. Plus, you can earn commissions while offering this essential service.

Experience the convenience of banking at your fingertips with Creative India’s MATM service. Our Micro ATM platform transforms how you handle financial transactions, making banking accessible even in the most remote areas. MATM is not just an ATM; it’s a compact, user-friendly device that brings essential banking services right to you. From cash withdrawals and deposits to balance inquiries and fund transfers, our MATM service makes banking quick, easy, and secure. With biometric verification, we ensure that every transaction is safe and personalized, giving you peace of mind and reliability with every interaction.

Banking at Your Fingertips with Creative India's MATM

At Creative India, we’re dedicated to closing the gap between urban and rural banking with our MATM service. We recognize the challenges people face in accessing banking facilities in remote areas, and our MATM solution is here to help. This service empowers local communities by giving them the tools they need to manage their finances effectively and independently. With our MATM devices, users can enjoy the benefits of digital banking without the hassle of complex setups or traveling to far-off bank branches. Our goal is to promote financial inclusion, ensuring everyone—no matter where they are—has access to essential banking services. Embrace the future of banking with Creative India’s MATM, where convenience meets security.

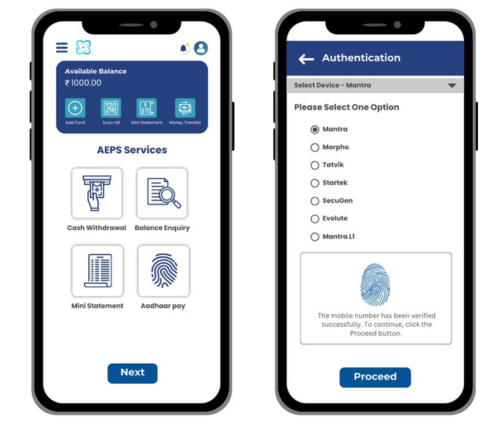

To launch this portal, you'll need to complete a verification process using a fingerprint scan or by swiping your Aadhaar card. Once your identity is confirmed, you can choose from various transaction options, including cash deposits, direct debits, eKYC-based savings accounts, Aadhaar seeding, cash withdrawals, balance inquiries, and service requests. Simply select the option you want, and a message will appear on the screen while your receipt is printed. After finishing the transaction, you'll receive a confirmation via SMS from your bank, just like usual.

You will get the following features in your mATM:

- Easy Installation

- Cash Withdrawal

- Balance Enquiry

- All Cards Acceptable

- Secure Transactions

- Additional Preferences

- Instant settlement

How does a Micro ATM work?

Micro ATMs are available at authorized dealer shops in rural and semi-urban areas and are operated by agents known as business correspondents. Customers can use these mATMs for cash withdrawals, deposits, transfers, balance inquiries, and more. With biometric features, mATMs ensure complete security for every transaction. Users can withdraw up to Rs. 10,000 at any time from an mATM.

Service Benefits

- Secure Payment:Moving your card details to a much mote secured place

- Trust Pay :100% Payment Protection. Easy Return Policy.

- 24/7 Support :We're here to help. Have a query and need help.